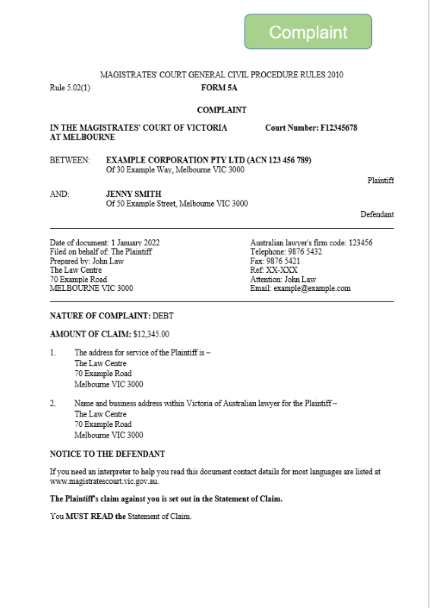

If you have received the document below

It means legal proceedings have been commenced against you

(you have been sued)

What are my options now?

Option 1 – Do nothing

As stated above, if you do nothing, then after 21 days the company that sued you will be allowed to apply to the Court for “default judgment”.

If this happens, a Court Order will be made against you that will require you to pay money. This Court Order will remain enforceable for 15 years.

It is very difficult to cancel (set aside) a Court Order after it has been made.

Therefore it is almost never a good idea to do nothing in this situation.

Option 2 – Submit an application to the Australian Financial Complaints Authority (AFCA)

We recommend putting in a Complaint to AFCA because:

– It is free;

– It puts the Court process on hold;

– It gives you more time to get advice about your situation.

You can make an AFCA complaint online here: https://www.afca.org.au/make-a-complaint

AFCA has the power to make a decision that the credit card company / debt collector must comply with.

For example, AFCA can make a decision that

– you owe less than the amount claimed; or

– that the credit card company / debt collector must pause your repayments because you are experiencing hardship.

Some reasons why you might want to make an AFCA Complaint are:

– You need more time to get advice, so you need to put the Court process on hold;

– You want AFCA to check whether the credit card company complied with the Responsible Lending Laws when they approved your credit card, or any subsequent credit limit increases;

– You believe that you owe less than the amount claimed;

– You believe that you do not owe the debt.

Option 3- Complete and submit a Notice of Defence with the Court

Submitting a Notice of Defence starts the Court process which means you will have a Court hearing to determine whether you owe the credit card debt.

If you start the Court process and ultimately lose, then the Court can order that you pay Court fees (a.k.a ‘Costs”) on top of what you owe for the credit card.

Therefore, you should only really consider filing a Notice of Defence in very limited circumstances, such as if:

- You have already made an AFCA Complaint and it was unsuccessful, and you have obtained legal advice recommending that you file a Notice of Defence;

- You have obtained legal advice that you have a defence to the credit card company / debt collector’s claims.