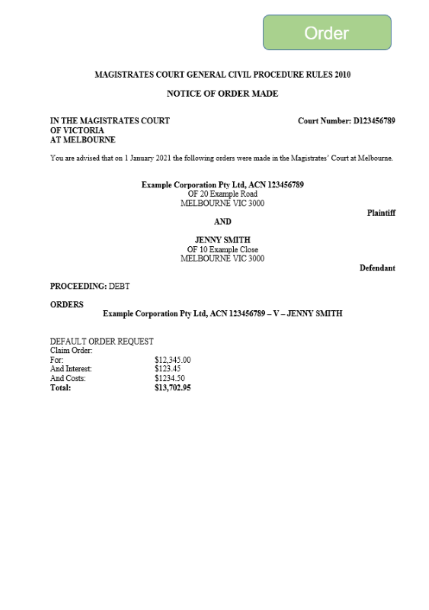

If you have received the document below

it means that a Court Order has been made against you

If this has happened, it means:

- The Court has decided that you owe the amount stated in the order;

- The amount you owe in the Court Order will accrue interest at the penalty interest rate (approximately 10% p.a.)

- You cannot dispute the fact that you owe the amount stated in the Order, unless you get the order cancelled (a.k.a “set aside), which is not easy to do (see Options 3 and 4 below for more information about setting aside a Court Order).

- The credit card company / debt collector can “enforce” the Court order in several different ways, such as:

-

- They can require you to come to Court to give information about your current financial situation (called a “summons for oral examination”)

- They can get the Sheriff to seize goods that you own worth more than $8700 (with a “warrant to seize personal property”)

- They can obtain an order against your employer to take up to 20% of your income to pay the amount owing in the Court order (called an “attachment of earnings order”)

- If the Court order is more than $10,000, they can apply for a “creditors petition” from the Bankruptcy Court to Bankrupt you (see below for what this means)

-

What are my options now?

Option 1 – Do nothing

If you do nothing, it is likely that the credit card company / debt collector will try to enforce the Court order.

They will usually start by serving you with a summons for oral examination to compel you to come to Court to answer questions about your financial situation.

Summons for oral examination

If you receive a summons for oral examination then you must go to Court and provide information about your financial situation.

If you refuse to go to Court, the credit card company can obtain a warrant to get the Police to come to your house. The Police will usually ask you to agree to go to Court, but they do have the power to arrest you and bring you to appear at Court. If you fail to go to Court after agreeing, the Police can charge you with a criminal offence.

If you go to Court you will be asked to provide information about your assets, debts, income and expenses.

The credit card company / debt collector will use the information that you disclose, to decide what other enforcement methods to use to compel you to pay the amount owing in this Court order.

For example:

– If you own a car worth $30,000, they will likely apply for a warrant to seize property to seize and sell your car.

– if you disclose that you earn $100,000 p.a. they will likely apply for an attachment of earnings order.

– If you own your own home, they may apply for a warrant of seizure and sale to force the sale of your home or they may apply for a creditors petition to bankrupt you.

More information about these different enforcement methods is provided below.

Warrant to seize property

The warrant to seize property gives the Sheriff the power to seize and sell any goods that you own that are not protected household property.

You usually can tell that you are dealing with the Sheriff because they look like the Police.

In practice, the most common thing that the Sheriff will try to seize is a car (if it is worth more than $8700, or if there’s a loan, the equity is worth more than $8700).

The Sheriff has the power to enter any address in Victoria that he/she reasonably believes contains the debtor’s personal property. The Sheriff may use force to enter the premises during certain times of the day.

If the Sheriff seizes personal property and you cannot pay the amount owing, the Sheriff can advertise and sell the seized property.

The money obtained by the Sheriff from selling your property is used to pay (in order):

- the Sheriff’s costs of execution

- the outstanding debt

- the debtor (if there are excess funds).

Attachment of earnings order

If you are employed, the credit card company / debt collector can apply to Court for an order directing your employer to pay up to 20% of your salary to the credit card company / debt collector until the Court order + interest, is completely paid off.

The credit card company / debt collector is required to provide you with Court documents up to at least 14 days before the hearing. The Court documents will contain the date, time and location of the hearing.

One of the Court documents will allow you to provide information to the Court about your financial situation (called a “Form 72C”).

You may not need to complete this if you have already provided this information in answer to the summons for oral examination.

If you have given information to the Court about your financial situation (either in answer to a summons for oral examination or in a Form 72C) then the Court will take that information into account when it decides how much you need to pay. The Court can order that between 0% and 20% of your earnings be taken to pay off the Court Order.

If you have not given information to the Court about your financial situation (either in answer to a summons for oral examination or in a Form 72C) then the Court must make an order that exactly 20% of your earnings be taken to pay the Court order.

You can appear at the hearing to provide argument as to what you can afford, but the Court will mostly rely on the information given in either the Form 72C or in answer to the summons for oral examination when it decides how much you should pay. For this reason, you should be truthful about all of your expenses, to ensure the Court doesn’t order that you pay too much, which may put you into financial hardship.

Creditors petition to make you bankrupt

If the debt is more than $10,000, the credit card company / debt collector can apply to the Bankruptcy Court to try to bankrupt you. There are several steps before an order can be made that you are bankrupt (called a “sequestration order”).

In most cases, the credit card company / debt collector will need to do the following, before you can be made bankrupt:

- Apply to the Federal Circuit Court for a Bankruptcy Notice;

- Serve you with the Bankruptcy Notice (usually by sending it to your last known address);

- Wait 21 days (If the debt is not paid in full within 21 days of service of the bankruptcy notice, you will commit an “act of bankruptcy”, which gives the creditor permission to start Court proceedings against you to make you bankrupt);

- File a creditors petition in the Federal Circuit Court (this is the start of the Court proceedings in which the Federal Circuit Court can make an order that you become bankrupt)

- Serve you with the creditors petition;

- Wait for the Federal Circuit Court to list the matter for a hearing.

- Have a hearing in the Federal Circuit Court and ask the Judge to make a “sequestration order” (which is the order that makes you bankrupt).

It is an expensive process to apply to make a person bankrupt. For example, it costs a company $4425 to file a creditors petition (or $6630 for a publicly listed company like a bank). Most credit card companies / debt collectors will not go down this path unless they have credible information that you have assets that can be sold to pay off the Court order (like real estate).

If you have received a Bankruptcy Notice and you have assets, such as a home, it is strongly recommended that you urgently get legal advice by calling 1800 466 477.

Once a sequestration order has been made, you will be made bankrupt for at least 3 years (which can be extended if you do not comply with the rules of bankruptcy).

If you are made bankrupt by the Court:

- You will have to disclose information about your financial situation (income, expenses, debts and assets) to the Bankruptcy Trustee.

- You can only earn up to a certain amount before you will be required to pay part of your earnings toward the Court Order. Further information can be found here.

- The Bankruptcy Trustee will be required to seize any goods you own and any real estate you own, and sell it, to pay the Court Order. The same rules about protected property apply. More information can be found here.

If you don’t have assets that the Sheriff can take, and your only income is from Centrelink, then none of the above enforcement methods will work to compel you to pay money to the credit card company / debt collector.

This is called being “judgment proof” (but “enforcement proof” is probably a better description).

If you are in this situation, you should send a letter to the credit card company / debt collector that is the Plaintiff in the Court Order explaining your current financial situation and stating that you cannot afford to pay anything towards the Court Order. They will likely leave you alone if they agree that you are “judgment proof”.

You may also want to speak to a Financial Counsellor about this, by calling the National Debt Helpline on 1800 007 007.

Option 2 – Apply to the Court to pay the judgment debt by instalments

If you have any assets or income that could be taken via the above enforcement methods, then you may want to consider applying to the Court to pay off the Court Order by instalments.

This is because the instalment order will put a stop all other enforcement methods as long as you are complying with the payments.

This means if you have a Court Order but you have not obtained an instalment order from the Court, then you face the risk of any of the above enforcement methods being used against you to take your income or assets (subject to the rules described above).

To apply for an instalment order, you have to follow the procedure stated here.

You should make sure to be as accurate as possible when describing your income and expenses, as the Court will rely on this information when deciding how much you can afford to pay.

The Law Handbook states, “Anecdotal evidence from financial counsellors has suggested that if a judgment debt is less than $10 000, any instalment application made must result in the debt being paid off within two or three years. With judgment debts of more than $10 000, anecdotal evidence suggests that the instalments may run over five years.”

Option 3 – Negotiate with the credit card company / debt collector to set aside a Court Order

Generally, there are two ways that you can set aside a Court Order:

- By consent; or

- By application to the Magistrates Court.

If you cannot get consent and have to apply to the Magistrates Court, see Option 4.

Generally speaking a credit card company / debt collector will be reluctant to consent to setting aside a Court Order.

This is because the credit card company / debt collector has spent money filing the Court documents, and (depending on how long it has been since the order was made) has generally spent money trying to enforce the Order (for example by obtaining a summons for oral examination, warrant to seize property or etc…).

If the credit card company / debt collector refuses consent, and you have to go to Court to get the Order set aside, then the Court will usually make you pay for the money that the credit card company / debt collector has spent on Court fees. This money is called the “costs thrown away”, because it is the money that the credit card company / debt collector wouldn’t have had to pay if you filed a notice of defence when you first received the Complaint.

When negotiating with the credit card provider / debt collector:

- You should consider writing to them and stating the following in your letter:

- that you are intending to apply to the Magistrates Court to set aside the order

- the date that the default judgment was entered, and the date that you first became aware of the order.

- your grounds for applying for the order to be set aside (See Option 4 for the reasons a Court will consider)

- that you are writing to ask if they would be willing to set aside the order by consent.

- that if consent is not forthcoming, that you will consider applying to Court.

- ask for their consent to be served via email.

- It is likely that if they are willing to consent to set aside the order, they will still ask for you to pay the costs thrown away.

- If you were not served properly, then you may want to dispute the need to pay the costs thrown away (as a Court is unlikely to order this, for more information see Option 4 below)

- If you were served properly then you should be prepared to pay this.

Option 4 – Apply to the Court to set aside the Court order

This part will consider how you can apply to the Court to set aside a Court Order.

If you are considering applying to Court set aside a Court Order, we strongly recommend you get legal advice. This is because you may end up needing to pay Court costs if you are ultimately unsuccessful in your application.

The Court will treat your application to set aside differently, depending on whether the Credit Card Company / Debt Collector followed the Court Rules when the Court proceedings were commenced (which usually depends on whether you were properly served with the Court Complaint).

If the Credit Card Company / Debt Collector did not serve you properly, then you are entitled to have the Court Order set aside, and you will not normally be required to pay the costs thrown away.

If the Credit Card Company / Debt Collector did serve you properly, then it will be at the discretion of the Magistrate, whether they set aside the Court Order.

Some of the things that the Magistrate considers when exercising this discretion are:

(a) whether the defendant has a defence on the merits;

(b) the reason for the default of the defendant in consequence of which the judgment was obtained;

(c) whether the application to set aside the judgment was made promptly after the judgment came to the knowledge of the defendant; and

(d) whether if the judgment were set aside the plaintiff would be prejudiced in any respect which could not be adequately compensated for by a suitable award of costs and the giving of security.

Cf. Rosing v Bem Shemesh [1960] VR 173 and Kostakanellis v Allen [1974] VR 596

If you were properly served with the Complaint, then it is likely that the Court will only set aside the order, if you agree to pay the “the costs thrown away” by the credit card company / debt collector.