Welcome to Credit Card Debt Help

Do you have a credit card debt?

The tools on this page were designed by the lawyers at the Consumer Action Law Centre to help you deal with your credit card debt.

The goal is:

- to generate a letter that you can send to your credit card company / debt collector; and

- to provide you with information tailored to your situation, about your legal rights and the next steps available to you.

Use the Blue Tabs above to navigate through the different Steps.

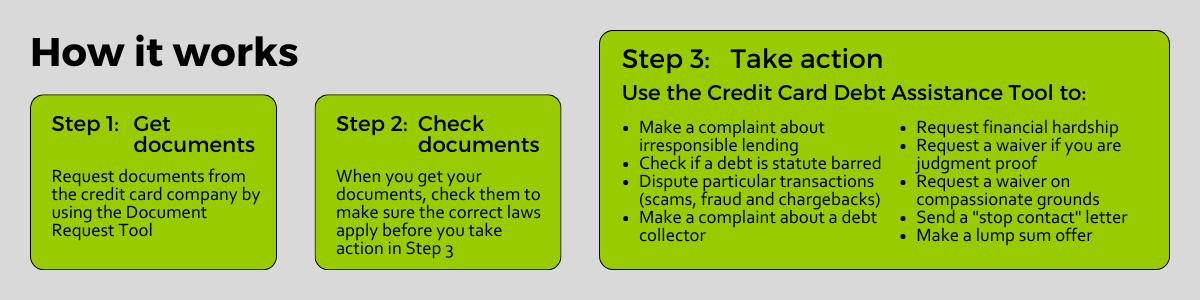

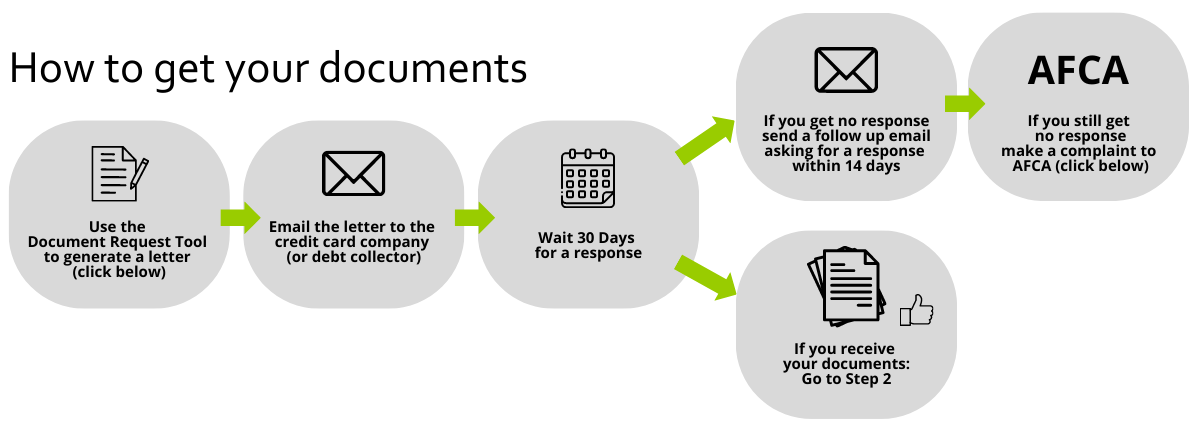

Step 1 – Request documents from the credit card company

You will need certain documents from your credit card company to use the tools on this page.

The Credit Card Debt Document Request Tool will generate a letter that you can send to the credit card company that requests the documents that you will need.

The Credit Card Company is required to provide these documents to you within specific timeframes stated in the National Consumer Credit Protection Act (Cth) 2009 and the National Credit Code.

If you don’t receive the documents in time, you should make a complaint to the Australian Financial Complaints Authority (AFCA).

Step 2 A – Check that the right laws apply

You must be living or working in Victoria

You must be living or working in Victoria

to use the tools in Step 3

(as we refer to laws applicable in Victoria)

[Click here] if you don't live or work in Victoria

| State | Community Legal Service | Legal Aid |

| New South Wales | Financial Rights Legal Service | Legal Aid NSW |

| Queensland | Caxton Legal Service | Legal Aid Queensland |

| Western Australia | Consumer Credit Legal Service | Legal Aid Western Australia |

| South Australia | Consumer Credit Law Centre of South Australia | Legal Services Commission South Australia |

| Tasmania | Tasmania Legal Aid | |

| Australian Capital Territory | Consumer Law Centre | Legal Aid ACT |

| Northern Territory | NT Legal Aid Commission |

Step 2 B – Check whether you have received Court documents

If you have received Court documents your legal options will be different.

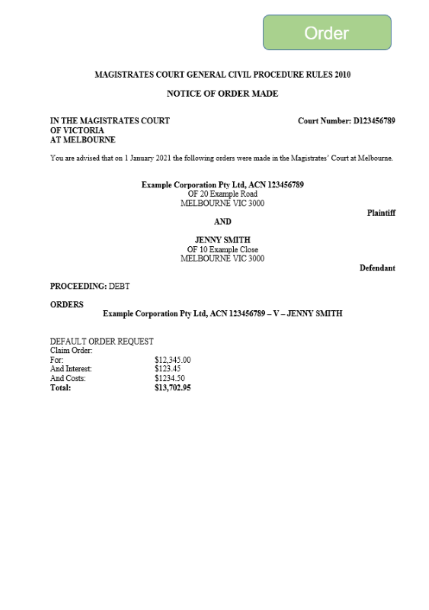

If you have received a Court Order:

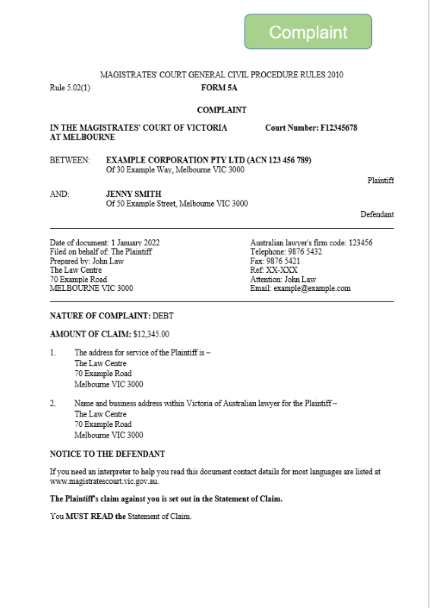

If you have received a Court Complaint:

If you have not received either:

Step 3 – Take action by sending a letter to the credit card company

- If you have received your documents from the credit card company, and you have checked them in Step 2, then you are ready to consider your legal options.

- Click Learn More to be taken to a page that will provide further information about each of the legal options below.

- For each option, you can use the Credit Card Debt Assistance Tool to generate a letter to send to the credit card company.

What will the Credit Card Debt Assistance Tool do?

The Credit Card Debt Assistance Tool will:

- generate a letter that you can send to your credit card company / debt collector; and

- generate a document that:

- gives further information about the legal option that you have chosen; and

- states what your next steps will be after you send the letter;

At the end you will receive an email with permanent links to both documents.

Check if your credit card debt has expired

If the debt is too old you may not have to pay it.

Make an irresponsible lending complaint

If the credit card limit approved was more than you could ultimately afford.

Send a “stop contact” letter

If you don’t want a debt collector to contact you about this credit card debt.

Request a waiver

if judgment proof

If you receive social security payments and have no substantial assets.

Disputed transactions, chargebacks, scams and fraud

If you dispute particular transactions made using your credit card.

[In Development]

Issues with debt collectors

Check if a debt collector has complied with the debt collection laws in Victoria.