Victorian Mum takes on consumer rental company Flexirent and wins

A Victorian Mum of four has won a settlement of nearly $4000 after she took legal action against Flexirent Capital Pty Ltd, a subsidiary of the ASX listed company FlexiGroup Limited.

Michelle Thompson (26) of Wonthaggi alleged that Flexirent failed to comply with its responsible lending obligations and entered into unjust contracts after it leased her products purchased at a Harvey Norman store.

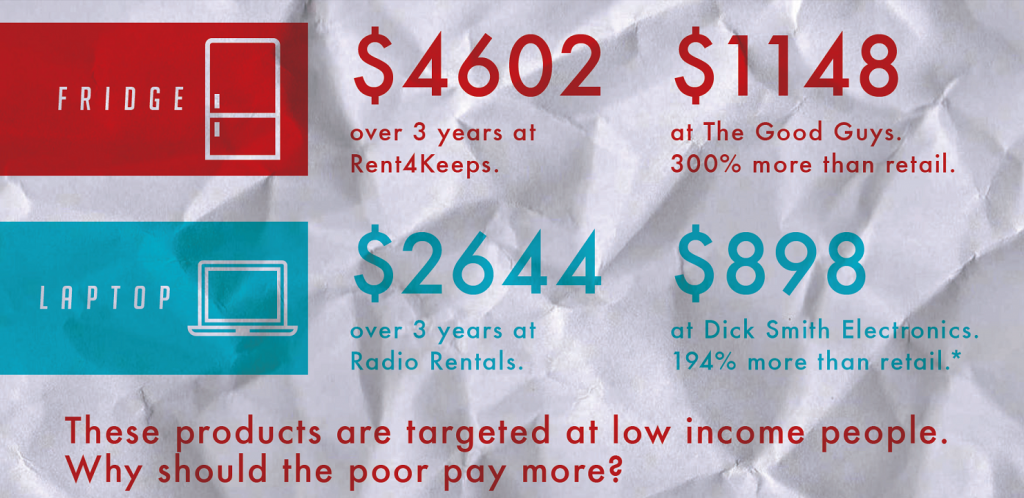

Between March 2011 and January 2013, Thompson entered into four separate rental agreements (commonly known as ‘consumer leases’ or ‘rent-to-buy’ products). Although the items were only valued at $9,917.78, the total amount of the rental payable was over $18,500. Despite this, she did not have a right to keep the goods.

Flexirent is legally required to ensure it lends responsibly and doesn’t cause further hardship when it sells to struggling Australians. It was alleged that Thompson, who survives on already insufficient welfare payments, could not meet the rental payments without suffering significant financial hardship.

“Michelle alleged that the rental agreements made it difficult for her to cover her ordinary living expenses, and that the contracts didn’t meet her requirements and objectives, in breach of the law.” says Lachlan Edwards, Solicitor at Consumer Action.

“In Michelle’s case she paid between 26 to 46% interest per annum on the goods, but this is only the tip of the iceberg in the consumer rental market – a recent report from ASIC found that the cost of some consumer leases from other companies can be as high as 884%*. If someone is struggling to make ends meet, an expensive lease can push them over the edge. That’s why lease providers have an obligation to assess a person’s capacity to make repayments before they rent out goods.”

Consumer Action CEO Gerard Brody says that a gap in the law means that retailers like Harvey Norman do not have to ensure that in-store finance is responsibly lent.

“These finance arrangements are being promoted by some of the biggest retailers in Australia and can often be really expensive and complex—retailers must take greater responsibility for the impact of products sold through their stores”, said Mr Brody.

“We’re warning Australians to think twice before signing up to an expensive consumer lease or rental scheme and get advice if they don’t understand. It’s a business model that relies on hiding extravagant costs behind a cheap sounding weekly or monthly cost. While it may seem like a good deal right now, it can be very costly in the long run.”

* Figure from ASIC: http://asic.gov.au/about-asic/media-centre/find-a-media-release/2015-releases/15-249mr-asic-finds-the-cost-of-consumer-leases-can-be-as-high-as-884/

Editor’s notes:

Gerard Brody is available for media comment.

Michelle Thompson is available to speak to journalists and happy to be photographed. She does not wish to be filmed.

Australians who are concerned about consumer lease debts can call 1800 007 007 for free and independent financial counselling Monday to Friday. Complaints about consumer leases can also be taken to the Credit and Investments Ombudsman.

What is rent-to-buy?

Rent-to-buy arrangements are legally known as ‘consumer leases’. A consumer lease is a contract for the hire of goods where:

- the hire is for domestic or household purposes;

- the person hiring the goods does not have a right or obligation to purchase the goods; and

- the total amount paid by the consumer is greater than the value of the goods being rented.

Consumer lease providers often rent basic household goods such as electronics, whitegoods and furniture to consumers. By the end of the contract, the consumer will typically have paid 2-5 times the normal retail cost. See our report on the hidden cost of rent-to-buy here.

The Government is currently reviewing the regulation of consumer leases and payday loans. See our submission to the review here.