Consumer Action supports ASIC use of new powers to tackle predatory credit agents such as Cigno

Businesses such as Cigno Pty Ltd, which facilitate access to predatory and unregulated payday loans by exploiting loopholes in the law, are on notice as the Australian Securities and Investment Commission (ASIC) confirms its intention to use its new regulatory powers.

ASIC has today released a consultation paper on its intended use of new Product Intervention Powers (PIPs) to address significant consumer detriment in the short-term credit industry.

One of the options proposed by ASIC is to limit the fees that can be charged by certain short-term lending business models to the level that may be charged under the ‘short term credit exemption’* that exists in existing national credit laws. This would prevent arrangements where businesses separate to the lender charge significant additional fees and charges related to the loan, without any requirement to ensure affordability.

Companies like Cigno say that they are an ‘agent’ rather than a lender, and that they arrange short-term cash loans of up to $1,000. The company says its “choice lender” is Gold Silver Standard Finance Pty Ltd (GSSF), which provides a loan that fits within the ‘short term credit exemption’. However, Cigno charges substantial additional fees, including fees to receive the loan funds on the same day. Due to its structure, Cigno is not regulated the way other payday lenders are, meaning it doesn’t comply with responsible lending laws.

Consumer Action Law Centre (Consumer Action) CEO, Gerard Brody welcomed the move, saying he is glad to see that ASIC now has Cigno in its crosshairs.

“Since 2015, Consumer Action’s legal practice has provided legal advice in relation to Cigno 117 times, including 37 times since the start of the year”, he says. “Many of the people contacting us, including financial counsellors supporting vulnerable clients, complain about unaffordable and exploitative loans facilitated by Cigno”.

“It is very welcome that ASIC is using its new powers here. The message for Cigno and similar business models is time is up: you can no longer use tricky business models to avoid the law.”

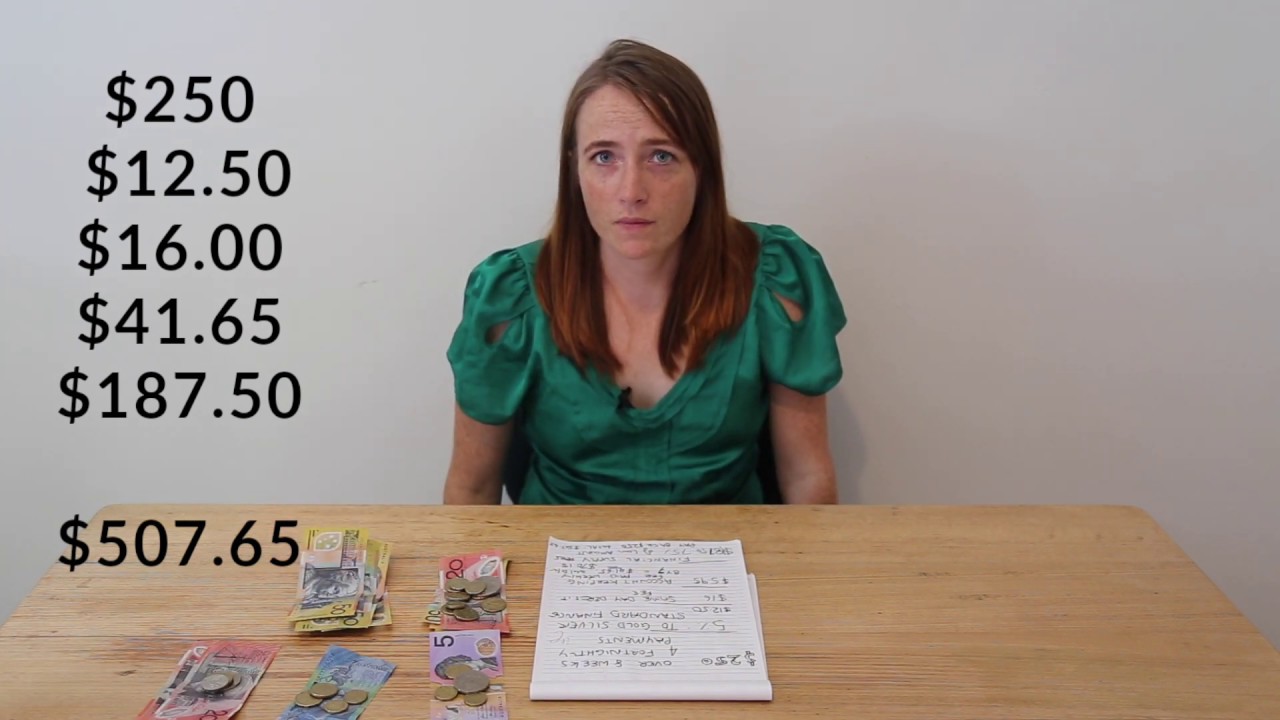

Consumer Action says that in addition to stopping harmful conduct, the regulator should give consideration to how people who have been harmed by this business receive compensation. The below video shows Consumer Action Senior Solicitor, Lisa Grealy explaining the fees charged by the Cigno and their impact on vulnerable borrowers.

Consumer Action also encourages ASIC to use its powers on a hit list of harmful products that continually cause detriment in the community, including credit repair, debt negotiation and budgeting services, ‘junk’ add-on insurance cover, funeral insurance and expenses only products, buy now pay later and dealer-issues warranties.

* The ‘short term credit exemption’ provides that national credit laws do not apply for credit contracts less than 62 days, where the maximum credit charge does not exceed 5% of the amount of credit and the maximum amount of interest does not exceed an annual percentage rate of 24%. In the case of Cigno and GSSF, consumers pay much, much more than these limits.

MEDIA CONTACT: 0413 299 567, media@consumeraction.org.au.

Does this sound familiar? If you or your client needs help with a similar issue, click here to contact one of our advice services.