Consumer credit insurance – Tips on reading your policy

It is good to check your policy wording so you can decide if your policy is suitable for you or get some advice if you are not sure what protection it gives you.

These are some things to look out for:

- If you were unemployed when you took out unemployment or disability cover

- If you were working part-time or working on a non-permanent basis when you took out unemployment cover

- If you were self-employed when you took out unemployment cover

- If you got life insurance, but had no dependents

- If you got disability cover or life insurance when you have a pre-existing condition.

Have a look below to see how this might look in your policy.

Unemployed

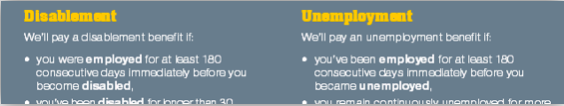

If you were unemployed when you bought the policy, your cover under a CCI policy is likely to be limited. Your policy might in fact require that you have been working for a certain amount of time, like this clause:

Non-permanent/casual work

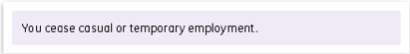

You policy might not provide cover if you work on a casual or non-permanent basis. So if your casual or temporary employment ends, you generally won’t be able to claim on the policy.

This is an example of what a casual work exclusion might look like in a CCI policy:

Part-time work

Sometimes CCI policies will not provide unemployment cover if you work part-time. Some policies say 15 and others say 20 hours, so it is important to check your policy.

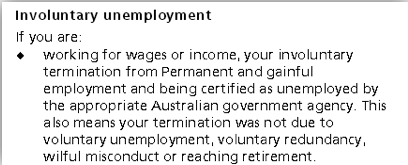

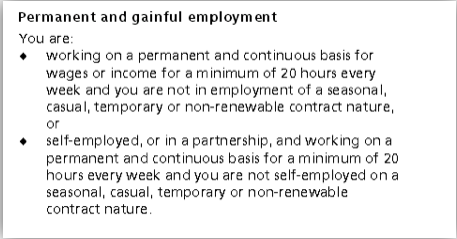

This policy provides unemployment cover in some circumstances. You have to have been working in ‘Permanent and gainful employment’ first:

The policy then describes ‘Permanent and gainful employment’ as being working for ‘a minimum of 20 hours every week’:

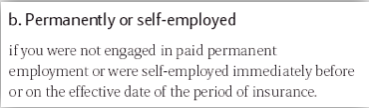

Self-employed

Some policies exclude or restrict cover for people who are self-employed. This could look like this:

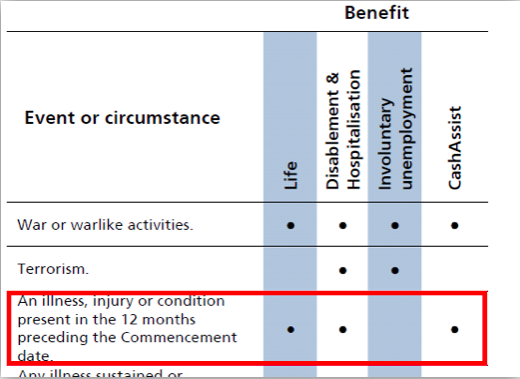

Pre-existing condition

If you have had a medical condition, for example, depression or osteoarthritis, your policy probably won’t cover you for claims that are caused by that condition. This is how the exclusion might look in your policy (the ‘dots’ mean you are not covered for those things):

Want more information?

The ASIC Money Smart website has really helpful information about consumer credit insurance.

If you want to read more about problems Australians have experienced with these products, have a look at Consumer Action Law Centre’s report, ‘Junk Merchants’ available here.

This fact sheet is for information purposes only and should not be relied upon as legal advice. This was updated on December 14, 2015.