Gap insurance – fact sheet

What is it?

Gap insurance (sometimes called ‘shortfall insurance’, ‘price protection insurance’ or ‘guaranteed asset protection’) is designed to provide cover for the ‘gap’ between:

- What you owe under your car loan; and

- What your car insurer pays out on your comprehensive car insurance if your car is a ‘write-off’.

Example:

You get a loan to buy a second hand car for $15,000. Once you include the interest, fees and charges on the loan, the total you have to repay on the loan is $22,000. You buy comprehensive car insurance on the car.

Now let’s say you are involved in an accident and your car is written off. Your comprehensive car insurance will pay you the market value for the car, which might only be $12,000, but you are still left with $10,000 to repay off your loan. This $10,000 is the ‘gap’.

What’s the problem?

- A tricky sales process. A salesperson will sometimes add gap insurance to a car loan without explaining what the product is, or without the customer even knowing they are buying it.

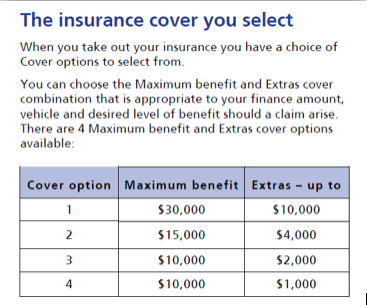

- You might have too little cover, or you might be paying for cover you don’t need. Sometimes the maximum payment under a Gap Insurance policy does not cover the gap the customer has. Other times, the insurance may cover a bigger gap than you will ever have (you may not have any gap at all) meaning you are paying for cover you don’t need. You can check your policy documents for what your limit is.

The document might have a table like this showing the amounts:

Your certificate of insurance will likely set out which option you have. If you are unsure check with your insurer.

- It can be very expensive. Expect to pay around $1000 for a gap insurance policy, and remember that if you’ve bought the insurance as part of your car loan, you’re also paying interest on that $1000.

What should you do?

Step 1: Check your policy to see what it covers or doesn’t cover and whether it is what you thought it was. You can ask your insurer for a copy of the certificate of insurance and the policy wording if you cannot find your copy. You can also ask your insurer what cover you have if you can’t work it out from the documents.

Step 2: Think back on when you were sold the insurance. Did you agree to buy this insurance or was it just bundled in with other papers when you got a car loan? Did you feel pressured to buy it? Were you given any incorrect information? Was the process unfair in any other way?

Step 3: If this insurance was added onto your loan without you knowing, the salesperson lied about the insurance or you think you were treated unfairly, you might be entitled to get a refund. You can use our template letter here.

Want more information?

The ASIC Money Smart website has really helpful information about gap insurance here.

If you want to read more about problems Australians have experienced with these products, have a look at Consumer Action Law Centre’s report, ‘Junk Merchants’ available here.

This fact sheet is for information purposes only and should not be relied upon as legal advice. This was updated on December 14, 2015.